The future of residential heating in the middle of an energy crisis

The energy market has been under tremendous pressure since BSRIA published its strategic analysis of the future HVAC market earlier this year. As the conflict in Ukraine becomes more intense and the gas supply from Russia dwindles, energy prices have skyrocketed, leading to a new way investment planning for policymakers and building owners.

Back in January 2022, BSRIA published its long-term European HVAC market outlook study, which looks at the potential development of residential heating systems– both fossil-fuelled and electrically driven– up to 2030. The study assesses the expansion of traditional systems versus greener technologies and analyses the market readiness from a legislative, energetical and consumer viewpoints, examining how products are likely to match investors requirements.

Market and product metrics BSRIA considered under the HVAC2030 report

At the time the research was conducted, the HVAC market was just recovering from the Covid crisis and most of the restrictions impacting businesses were lifted in Europe. EU countries had taken measures to accelerate their energy transition through various financial incentives to boost the replacement of inefficient systems. The demand in retrofit was burgeoning, new construction projects went live again, and as a result, many suppliers experienced shortages of stock components and orders started to pile up.

Now, eight months into the Ukraine war, the European energy market has turned upside down. Gas prices reached an all-time high last August, putting governments under huge pressure to diversify their suppliers and reduce their consumptions. Financial incentives for gas boiler were reduced in Germany, and even cut in France. As factories slash their production hours in a bid to save on utility bills, and households now grapple with impossibly expensive energy bills, public awareness for high-efficiency renewable heating systems has never been higher.

BSRIA estimated the total volume of heat pumps sold to be close to 20 million units between 2020 and 2030 at the beginning of 2022. The market is now predicted to ramp up further. During the first half of 2022 alone, the market for space heating heat pumps went up 20% in Europe and the trend shows no sign of slowing down. Major international HP suppliers reported to BSRIA that they could hardly keep up with the demand. Many noted bottlenecks in the production of some parts, such as circulators, fans, heat exchangers and electronics, partly because of delays in imports from China. To cope with that, European manufacturers announced heavy investment to scale up the production of HP in the region. Bosch, Daikin, Stiebel Eltron, and Viessmann, will invest altogether over 3.1billion euros into production facilities within Europe within the next three years.

Other technologies, such as biomass boilers and district heating networks on low carbon sources, are also drawing attention. A key question is to understand how quickly the price of technologies is likely to go down. With surging raw material and energy prices affecting the whole industry, some homeowners must choose between heating and eating. Where is the market expected to end up by 2030? Will the current gas crisis accelerate the path towards decarbonisation?

In an attempt to shed light on the future European heating market, BSRIA will run an update of its HVAC2030 study, by reassessing consumers’ attitude under the current energy climate and taking into consideration the revamped industrial landscape. The focus will remain on the key major markets covered under that analysis namely; France, Germany, Italy, the Netherlands and the UK.

For further information about the study, please contact:

European sales enquiries: BSRIA UK: wmi@bsria.co.uk www.bsria.com/uk/

America sales enquiries: BSRIA USA: sales@bsria.com www.bsria.com/us/

China sales enquiries: BSRIA China: bsria@bsria.com.cn www.bsria.com/cn/

This article appears on the BSRIA news and bog site as "The future of residential heating in the middle of an energy crisis" dated December 2022.

--BSRIA

[edit] Related articles on Designing Buildings

Featured articles and news

CIOB Client Guide (2nd edition) March 2025

Free download covering statutory dutyholder roles under the Building Safety Act and much more.

AI and automation in 3D modelling and spatial design

Can almost half of design development tasks be automated?

Minister quizzed, as responsibility transfers to MHCLG and BSR publishes new building control guidance.

UK environmental regulations reform 2025

Amid wider new approaches to ensure regulators and regulation support growth.

The maintenance challenge of tenements.

BSRIA Statutory Compliance Inspection Checklist

BG80/2025 now significantly updated to include requirements related to important changes in legislation.

Shortlist for the 2025 Roofscape Design Awards

Talent and innovation showcase announcement from the trussed rafter industry.

OpenUSD possibilities: Look before you leap

Being ready for the OpenUSD solutions set to transform architecture and design.

Global Asbestos Awareness Week 2025

Highlighting the continuing threat to trades persons.

Retrofit of Buildings, a CIOB Technical Publication

Now available in Arabic and Chinese aswell as English.

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

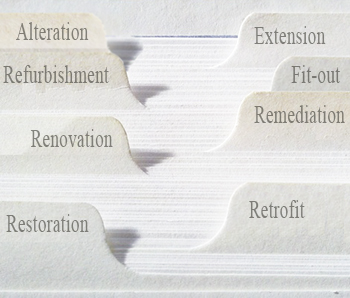

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.

How can digital twins boost profitability within construction?

The smart construction dashboard, as-built data and site changes forming an accurate digital twin.

Unlocking surplus public defence land and more to speed up the delivery of housing.

The Planning and Infrastructure Bill

An outline of the bill with a mix of reactions on potential impacts from IHBC, CIEEM, CIC, ACE and EIC.

Comments

[edit] To make a comment about this article, click 'Add a comment' above. Separate your comments from any existing comments by inserting a horizontal line.